How does the insurance car sale work?

Normally, the sale of insurance cars is due to certain actions that occurred, because although this has resulted in a total loss, the insurer achieved a short time after the total repair of this, or, when it was stolen, they sometimes find it just a few blocks ahead , and in front of all these situations are those that begin the functions on the part of the insurance companies in making the sale of their insured cars.

Therefore, the reality is that this commercialization is carried out as we have already told you before due to a total loss, where it sounds like one of the purchases a little more viable, however, take into account the investment that this may require with regarding your repairs.

On the other hand, there are also stolen cars, which require a somewhat complex process, since these, although sometimes do not request expenses for repairs, the truth is that they end up being able to harm you.

We tell you this because there are often situations in which the vehicles already belong in their entirety to a new owner, who has already received the corresponding title and with all the legal procedures online, however it happens that the unit is still included in the Police systems of various entities of the Mexican Republic as stolen, for this reason it is recommended that when acquiring insurance vehicles with a history of theft, you carry the invoice or title notified by the corresponding authorities, this is how you will avoid any misunderstanding.

Advantages and disadvantages of insurance cars

In the first point, the advantage that you will be able to notice is that obviously the accessible price for which you can buy your car from an insurance company, since also when attending an auction, it helps you receive a cost with at least 40 or 50% less at commercial value.

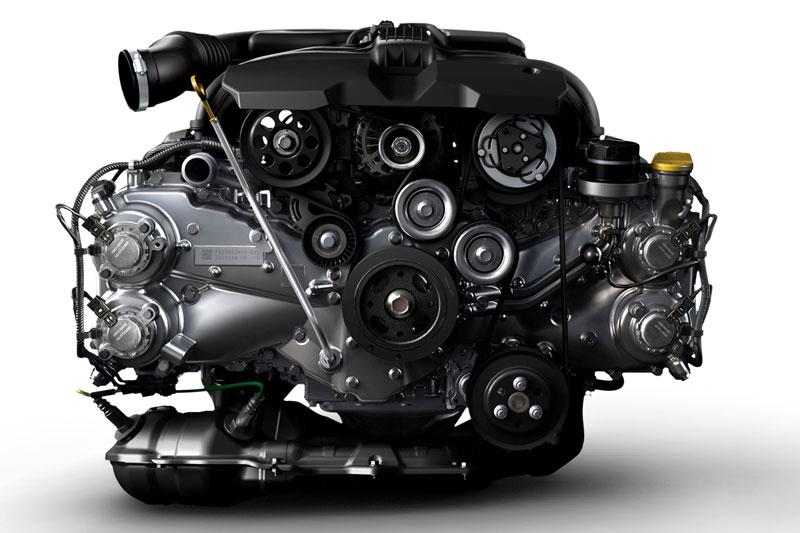

The disadvantages, on the other hand, are, as we already mentioned, those that are directly related to the high costs that their repairs can bring you, we also do not know how the mechanisms of the unit are. Finally, all those procedures that you have to carry out enter, which end up being quite time-consuming.

What are insurance car auctions?

Insurance car auctions occur when the insurance company takes time to accommodate the cars that it recovers or repairs, then in order for them to generate some profit, they are put up for auction, where the employees of the same company or public in General makes offers and the one that is most convenient will be taken.

Insurer car insurance

Being considered an insurance car, the reality is that the company does not know the state in which the vehicle is, because despite having been repaired or recovered, it is not known about the possible damage it may have in its structure, so The insurance for these cars is only viable from the broad coverage, which includes protection for civil liability in damages to third parties, road assistance, legal advice, as well as services with covered medical expenses.

It should be noted that insurers usually provide coverage for total theft where an indemnity corresponding to the same value for which you acquired it is agreed.