Where Financial Spreading Meets Credit Intelligence

Is your financial analysis process empowering smarter credit decisions—or holding them back?

Banks, credit unions, and lending institutions can’t afford to make decisions based on slow, manual processes in today’s fast-paced financial world. Yet many still rely on outdated tools for analyzing financial statements, leaving room for error and inefficiency. This blog explores how modern financial spreading intersects with credit intelligence to revolutionize how institutions evaluate borrowers, reduce risk, and accelerate loan processing with confidence and accuracy.

Understanding the Value of Financial Spreading

Financial spreading is extracting key figures from borrower financial statements and standardizing them for analysis. Traditionally, this involved a tedious, manual data transfer into spreadsheets or loan origination platforms. Not only was this time-consuming, but it was also highly prone to human error.

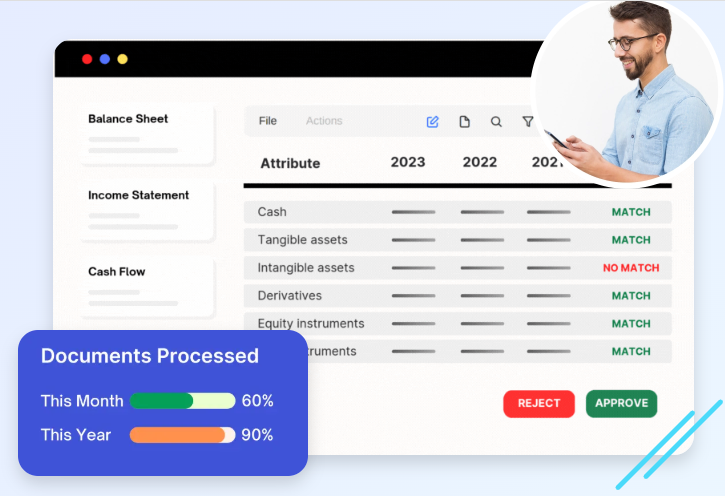

Modern financial spreading software automates this entire process. It digitizes and extracts data from various financial documents—like income statements, balance sheets, and cash flow statements—and then organizes it into a structured, analysis-ready format. The result? Cleaner data, faster decisions, and reduced underwriting time.

The Shift Toward AI-Driven Spreading

Thanks to artificial intelligence and machine learning advances, financial institutions are shifting toward automated financial spreading solutions that learn over time and adapt to varied document formats. AI-powered platforms like Collatio use natural language processing (NLP) and advanced data recognition to accurately extract and reconcile financial data—even from scanned or non-standardized files.

This shift improves accuracy and enables seamless integration into existing credit workflows, paving the way for smarter credit decision-making at every stage.

Credit Intelligence: Beyond Just Numbers

While financial spreading handles the “what” of the borrower’s financials, credit intelligence answers the “so what?” It uses structured data and analytical models, scoring systems, and contextual insights to deliver meaningful creditworthiness assessments.

Combining financial spreading with credit intelligence allows underwriters to move from data entry to data analysis quickly. Instead of hunting for figures, they interpret trends, identify risks, and advise on loan structures. This synergy increases both the speed and quality of decisions.

Automation Enables Consistency and Compliance

Regulatory compliance is a constant concern in lending. Manual data entry opens the door to inconsistencies, missing documentation, and audit vulnerabilities. With automated financial spreading, institutions benefit from a consistent, repeatable process that maintains a detailed audit trail.

Each data point is time-stamped and traceable, making it easier for compliance officers to review decisions, validate inputs, and ensure accuracy throughout the underwriting journey. This built-in transparency supports stronger governance and smoother audits.

Enhanced Risk Assessment Through Smarter Analysis

Risk assessment doesn’t stop at collecting numbers—it’s about interpreting what those numbers say about a borrower’s future. By pairing financial spreading with credit intelligence tools, institutions gain a deeper understanding of key metrics like debt-to-income ratio, EBITDA, current ratio, and cash flow adequacy.

AI platforms can even flag anomalies, benchmark against industry standards, or trigger alerts based on pre-set thresholds. With this proactive risk monitoring, lenders can better anticipate defaults and reduce portfolio exposure before they become problematic.

Time Is Money—And Automation Saves Both

Loan processing timelines can mean the difference between winning or losing a client. Traditional financial spreading might take hours—or even days—for a single borrower. Multiply that by dozens or hundreds of applications, and you’re looking at a serious bottleneck.

Automated spreading tools can process hundreds of pages of financials in minutes. This dramatically reduces the time from application to approval, helping institutions serve more clients more efficiently—without compromising due diligence.

Built for Scale and Customization

Financial institutions range from boutique lenders to multinational banks. What makes modern financial spreading platforms powerful is their scalability. Whether you’re processing five or five hundred spreads daily, automation adapts to your volume.

Additionally, customizable templates allow institutions to align spreading output with their internal credit models. This flexibility ensures that your credit team receives the exact data points and financial ratios they need for consistent evaluations—every single time.

Integrations Drive End-to-End Intelligence

The magic happens when financial spreading integrates seamlessly with your broader credit technology ecosystem. Whether it’s a loan origination system (LOS), CRM, or risk management dashboard, modern platforms are built with APIs that ensure data flows securely and efficiently between systems.

This eliminates duplicate data entry, reduces manual intervention, and accelerates underwriting. More importantly, it ensures that every stakeholder—from analysts to executives—can access up-to-date, actionable insights at every step.

Conclusion

Institutions embracing automation and intelligence will lead the way as the financial landscape evolves. The intersection of financial spreading and credit intelligence isn’t just a technology upgrade—it’s a fundamental transformation of financial decisions.

Lenders can deliver faster, smarter, and more compliant credit decisions by combining structured data automation with advanced analytics. From cutting loan processing time to reducing risk and improving accuracy, the benefits are tangible and immediate.

If your institution is ready to move beyond manual processes, it’s time to bring financial spreading and credit intelligence together—because the future of lending depends on it.