Why Smart Business Owners Are Choosing Offshore Bookkeeping Services in 2025

As businesses grow and evolve, managing finances with accuracy and efficiency becomes more challenging. In 2025, more companies—especially small and mid-sized businesses—are turning to offshore bookkeeping services as a cost-effective, scalable solution. It’s not just about cutting costs; it’s about gaining access to expert support, better technology, and reliable financial processes that drive business growth.

If you’re still managing your books in-house or through a limited local setup, now might be the time to consider going offshore. Here’s why offshore bookkeeping services have become the smart choice for forward-thinking business owners and what benefits they offer.

What Are Offshore Bookkeeping Services?

Offshore bookkeeping means delegating your business’s financial record-keeping tasks to a third-party team located in another country—typically one with skilled professionals and lower operational costs. These tasks often include:

-

Recording daily transactions

-

Managing accounts payable and receivable

-

Bank reconciliations

-

Monthly financial reporting

-

Payroll processing

-

Tax preparation assistance

-

Financial analysis and forecasting

Thanks to secure cloud-based tools, working with offshore bookkeepers is seamless and real-time—even if they’re thousands of miles away.

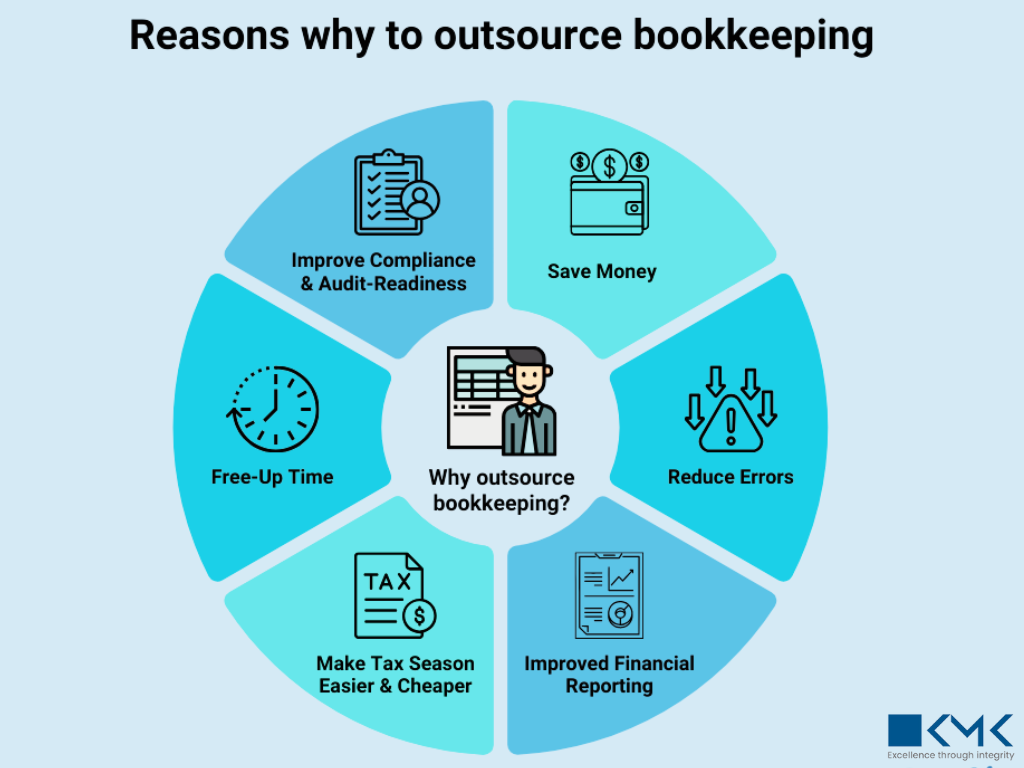

Why Businesses Are Going Offshore in 2025

1. Significant Cost Savings

The number one reason businesses choose offshore bookkeeping is the cost advantage. Offshore firms—especially those based in countries like India, the Philippines, or Eastern Europe—offer high-quality services at a fraction of local prices. You save on:

-

Salaries and benefits

-

Hiring and training costs

-

Office space and infrastructure

-

Software and tech expenses

This enables you to reinvest those savings into core business functions like marketing, product development, or customer experience.

2. Access to Qualified Professionals

Offshore bookkeeping providers employ experienced accountants and financial experts who understand international accounting standards and tax regulations. Many teams are trained in:

-

GAAP (Generally Accepted Accounting Principles)

-

IFRS (International Financial Reporting Standards)

-

QuickBooks, Xero, Zoho Books, and other cloud tools

With the right offshore partner, you gain expertise without the cost of full-time in-house staff.

3. More Time to Focus on Business Growth

When bookkeeping is handled offshore, your in-house team no longer needs to spend hours each week on data entry, reconciliations, or chasing invoices. This allows you to:

-

Focus on strategic growth

-

Improve customer service

-

Launch new products or services

-

Strengthen business relationships

In short, outsourcing frees your internal resources to do what they do best.

4. 24/7 Operations and Faster Turnarounds

With time zone differences, offshore bookkeeping teams can work while you’re off the clock. For example, your books can be updated overnight, so you start your day with fresh financials.

This around-the-clock productivity means:

-

Faster monthly closes

-

Prompt financial reporting

-

Real-time business insights

-

Better cash flow management

5. Improved Accuracy and Reduced Errors

Offshore providers use standardized processes and multiple levels of quality control to minimize errors. With cloud-based systems and automation tools, your financial data is processed more accurately and consistently.

Plus, since bookkeeping is their core service, offshore firms are dedicated to maintaining accuracy and compliance—which lowers your risk of tax penalties, misstatements, or audit issues.

6. Scalability and Flexibility

As your business grows, so does your bookkeeping workload. Offshore services allow you to scale effortlessly—adding more resources or upgrading services without needing to recruit and train new staff.

Whether you’re a startup or a growing enterprise, offshore bookkeeping providers offer flexible plans tailored to your:

-

Industry

-

Business size

-

Monthly transaction volume

-

Reporting needs

7. Data Security and Confidentiality

In 2025, top offshore bookkeeping providers prioritize data security and regulatory compliance. They invest in:

-

Encrypted communication

-

Secure cloud storage

-

Regular data backups

-

NDAs and confidentiality agreements

Make sure to partner with a firm that is ISO-certified or GDPR-compliant and uses secure accounting platforms to protect your financial information.

Is Offshore Bookkeeping Right for Your Business?

Offshore bookkeeping is a great fit for businesses that:

-

Want to cut costs without sacrificing quality

-

Have outgrown basic DIY accounting

-

Need access to professional financial expertise

-

Want to scale operations efficiently

-

Prefer to focus on growth, not back-office tasks

Whether you’re in e-commerce, consulting, manufacturing, or professional services, offshore bookkeeping offers clear value for your business model.

How to Choose the Right Offshore Partner

Success with offshore bookkeeping depends on choosing the right provider. Look for:

✅ Proven experience with clients in your industry

✅ Certified professionals and transparent pricing

✅ Use of trusted accounting software (QuickBooks, Xero, etc.)

✅ Strong communication and support system

✅ Testimonials or case studies from happy clients

✅ Data security and confidentiality protocols

A great provider should act as an extension of your business, not just a vendor.

Final Thoughts

In 2025, offshore bookkeeping services are no longer just an option—they’re a smart business move. They help you save money, gain expertise, improve efficiency, and stay focused on growing your business. With secure technology and experienced professionals just a click away, outsourcing your bookkeeping offshore could be the strategic step your business needs to scale with confidence.

At KMK Ventures, we provide reliable, secure, and customized offshore bookkeeping solutions designed to meet your unique needs. Whether you’re looking for basic support or end-to-end accounting services, our team is here to help you succeed—without the overhead.