NACA will not explore a credit-score-depending method of pre-qualifying homebuyers

A nearby Advice Organization away from The united states, or NACA, support lower-and-average income homebuyers safer investment to get and you may redesign house. Established in 1988, NACA lay a target to build strong communities compliment of sensible homeownership.

What does NACA Carry out?

NACA prepares upcoming property owners which have economic training and you may help. The business now offers economic counseling to be sure a purchaser can handle the fresh new connection wanted to buy a home and you may pay for ongoing future costs associated with homeownership. NACA participants supply accessibility lenders offering a reduced-rates, no-percentage mortgage.

Homebuyers who maybe not be eligible for a conventional financial may start to NACA having guidance. As an alternative, this new nonprofit organization arranged its tech and you may underwriting assistance paying attention on the reputation-based lending. If the candidates feel NACA-licensed, they are able to make an application for home financing through the organization’s homebuying program.

Exactly how NACA Helps Homeowners

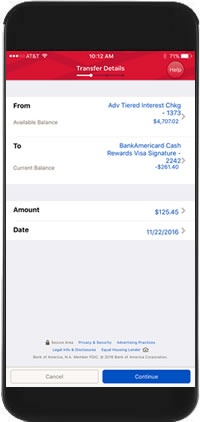

NACA have more than forty offices in the nation, with many different based in higher locations such as New york city, Boston, Chicago, and Washington, DC. NACA will not originate mortgages however, works with external lenders, such as for instance Bank of The usa, to provide what the nonprofit makes reference to given that Better Financial in the usa. Between 1996 and you may 2021, Financial out of America and NACA’s commitment triggered more than 42,000 mortgages.

NACA believes about stamina away from homeownership and strives to aid low-and-modest earnings customers which might not usually be eligible for a mortgage. Every year, NACA keeps neighborhood events across the country for the Queens, New york, Baltimore, MD, and you may Miami, Florida. These types of events mark tens of thousands of attendees wanting to learn about which unique home-to get opportunity.

The fresh organization’s means initiate by teaching potential real estate buyers using four-time courses. The fresh new program’s loan recognition philosophy considers a keen applicant’s work balance and you will capability to make ends meet sensed significantly less than its manage.

As well, NACA facilitates most other regions of homeownership, also home renovations, owing to their residence and you will Community Institution (HAND). Immediately after payment, this new Membership Guidance Program (MAP) aids the fresh home owners helping those in economic stress stop foreclosures.

So what does NACA Require Out of Homebuyers?

If you’re wanting good NACA mortgage, you can discover more info on the firm of the probably a community enjoy and you can talking to their staff and you will volunteers. To sign up the brand new NACA processes, you ought to plan to list of positive actions:

Sit-in good Homebuyer Working area

The method begins with a no cost Homebuyer Workshop. You don’t need to to join NACA to visit this very first event. In the working area, you will then see throughout the NACA’s certification procedure and you can pay attention to testimony out-of others that utilized NACA to help get their home.

Live-in the home you buy

NACA provides accessibility resource to have consumers selecting to shop for an excellent family that will aid as their top residence. NACA commonly put an excellent $25,000 lien with the possessions to ensure the home stays owner-filled whenever bought using a great NACA home loan. You can not make use of the NACA system purchasing an investment property, apart from multi-household members features where owners live-in one of several systems. Once you purchase a property as a result of NACA, you can’t very own any kind of domestic. The NACA system lets timeshares.

Yourself be involved in the business

NACA requires the players privately sign up to the organization by way of advocacy otherwise volunteering at the very least of five events on a yearly basis. NACA including charges a nominal membership payment out-of $twenty-five.

NACA Loan Conditions

People whom getting NACA-licensed can apply to own a home loan through the nonprofit’s credit lovers and found the lowest-price, payday loans no-commission loan. As the NACA system prioritizes reduced- and you will modest-money somebody, higher-income people looking to purchase homes inside communities identified as priority elements may participate. However, non-concern buyers will get found smaller advantageous rates.