Financial Spreading Automation That Handles Any Format

Is your team wasting hours manually pulling data from PDFs, scanned images, and spreadsheets to prepare financial statements for analysis? You’re not alone. This outdated process slows operations and introduces avoidable risks in today’s high-volume, fast-paced financial environment.

This blog explores how advanced financial spreading automation can efficiently process financial data, regardless of the file format or document structure. You’ll discover how AI-driven solutions revolutionize how banks, lenders, analysts, and financial institutions extract, standardize, and use financial information at scale.

The Challenge With Traditional Financial Data Handling

Financial professionals often encounter various documents: scanned statements, native PDFs, spreadsheets, and handwritten reports. Manually processing these disparate formats is time-consuming and error-prone. Inconsistent layouts, missing labels, and format-specific quirks can disrupt the spreading process and delay downstream workflows.

This is why scalable, format-agnostic financial spreading automation is quickly becoming necessary for institutions that manage diverse portfolios, support multiple geographies, or serve clients across industries. Automation isn’t just about speed but consistency, accuracy, and long-term scalability.

AI-Powered Extraction Across Any File Type

Modern financial automation platforms use a combination of Optical Character Recognition (OCR), Natural Language Processing (NLP), and Machine Learning to read and interpret documents, regardless of how they are structured or formatted. These systems identify key financial metrics across different layouts and terminology, such as net income, assets, liabilities, and cash flows.

What makes this level of financial spreading automation so valuable is its ability to handle documents from any source: scanned PDFs from small businesses, Excel reports from corporate borrowers, or multi-language statements from global subsidiaries. The result is unified, machine-readable data ready for immediate analysis.

Consistent Standardization for Smarter Comparisons

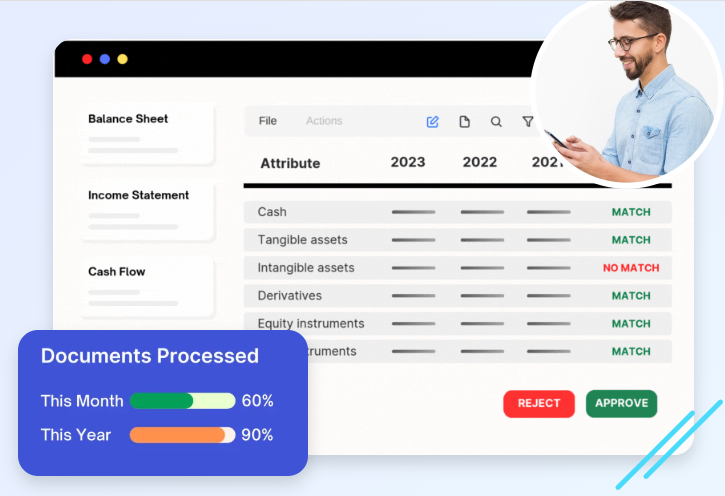

Once extracted, financial data needs to be standardized to enable reliable comparison across companies, years, and industries. AI-based systems automatically normalize financial statements—mapping terms like “Total Revenues” and “Net Sales” to a common schema so analysts can benchmark results.

This intelligent transformation makes financial spreading automation essential for credit risk teams, underwriters, and investment analysts who must evaluate performance across mixed-format documents. Standardization ensures no key detail is lost or misunderstood due to inconsistent labeling or document styling.

Real-Time Reconciliation and Validation

Accuracy is critical in financial reporting. AI platforms extract and format data and cross-verify it across statements to ensure numbers align. For example, the system flags the discrepancy in real time if total liabilities on a balance sheet don’t match the calculated figure from supporting schedules.

This built-in reconciliation engine ensures that financial spreading automation doesn’t just save time—it also improves reliability. Analysts can trust that the data is clean and accurate before making high-stakes decisions, reducing audit risk and reinforcing regulatory compliance.

Multi-Language and Global Document Support

In today’s global financial landscape, working with financials in Spanish, French, Mandarin, and beyond is common. AI-powered solutions are trained to recognize and interpret multilingual documents, converting all inputs into a common output format.

That’s why format-flexible financial spreading automation is especially valuable for multinational banks, cross-border investment firms, and global lending institutions. It eliminates the need for separate workflows by enabling one unified system to process all documents, regardless of language, currency, or accounting style.

Visual Dashboards and Financial Ratio Insights

Extracted data is only useful if it drives insight. Modern automation platforms provide visual dashboards where analysts can view key financial ratios, trends, and year-over-year performance metrics at a glance. These dashboards are interactive and update in real time as data is processed.

This functionality ensures financial spreading automation is more than just a back-office efficiency tool—it actively supports strategic decision-making. Analysts can rely on instant insights built on structured, accurate financial data, whether reviewing a loan application or evaluating an acquisition company.

Integration With Enterprise Workflows

To be truly valuable, automated systems must integrate seamlessly into existing workflows. Today’s best financial spreading tools offer APIs and data connectors that push results directly into CRM systems, risk engines, or reporting dashboards. There’s no need to transfer or re-enter information manually.

With this level of integration, financial spreading automation becomes a core component of enterprise finance operations, driving consistency from intake to insight. This not only saves time but also reduces human error at every touchpoint.

Scalable Performance for Growing Teams

Manual processes may work for small teams or low-volume portfolios, but quickly break down at scale. Financial institutions managing hundreds or thousands of monthly statements need automation that can scale with demand without degrading quality.

AI-driven financial spreading automation handles high volumes effortlessly. Whether it’s a spike in quarterly loan applications or a sudden increase in M&A activity, the system processes documents around the clock with no drop in accuracy or speed.

Conclusion

In a world filled with variable formats, global clients, and high data volumes, automation that only works in specific conditions is no longer enough. The future belongs to AI-driven solutions that adapt to any file type, language, or structure—and deliver accuracy at scale.

By adopting financial spreading automation, institutions gain faster turnaround times, stronger data governance, and actionable insights, without the manual bottlenecks. Every team benefits from underwriting and risk management to financial modeling and compliance.

If your organization is ready to move beyond outdated methods and embrace intelligent automation, now is the time. Let your data work smarter, not harder.